The Church of Scientology is reeling from the felony criminal indictment of Scientologist Danny Masterson for raping three different women, which has him facing 45 years to life in prison if he’s convicted.

Meanwhile, this website on Saturday updated us on the saga of Scientologist chiropractor Jay Spina, who will be sentenced on July 6 for a stunning and elaborate Medicare scam that not only resulted in millions of dollars in losses, but also the loss of a patient in a sketchy program of injections by a physician working for Spina who had trained himself by watching YouTube videos.

But there’s another Scientology-related crime story that we have been following at The Scientology Money Project for some time: Scientologist David Gentile and his scandal-plagued private equity firm GPB Capital Holdings of New York have been hit with new charges of extensive securities violations by the Enforcement Section of the Massachusetts Securities Division.

GPB Capital Holdings is a spinoff of Gentile, Pismeney & Brengel, a Long Island CPA Firm owned by David Gentile’s father Santo Gentile and his partners Kyle Brengel and Bernard Pismeney. David Gentile worked as a CPA at his father’s firm for many years before he partnered with his long-time client Jeffry Schneider, a securities broker with red flags as shown by his public record published at FINRA’s BrokerCheck website. Among other details, the Massachusetts complaint details the incredible greed-driven self-dealing between Gentile and Schneider. For the first time, Schneider is named as Gentile’s “top confidant,” a term we take to mean “co-conspirator.”

We have documented the ties between GPB Capital Holdings and the Russian organized crime figure Michael Cherney via his daughters Rina and Diana Chernaya. We have also shown that David Gentile and the Chernaya sisters partnered in a 2012 investment in an Irish online gaming company called SeanieMac. Michael Cherney’s US business agent Robert Kessler of New York City also invested in this deal. (For specific details, see our story on the background influences of GPB Capital Holdings.) The past connections between David Gentile and his colleagues at GPB Capital also include Hunter Biden and a Jeffrey Epstein associate, Amanda “Mandy” Ellison.

GPB Capital Holdings has raised $1.8 billion from investors since its inception in 2013. When GPB was forced to disclose its current valuation in 2019, the news was stunning: GPB admitted to a $700 million loss across its many funds. Where did the $700 million go? This is one of the major questions into which investigators and securities law firms are looking.

What stood out to us was GPB’s admission that its New York City waste management portfolio was down a staggering 79 percent. Waste management has long been linked to organized crime in New York City. Tellingly, in February 2019 the FBI raided both the New York City corporate headquarters of GPB Capital Holdings and its Five Star Waste Management component.

Secretary of the Commonwealth of Massachusetts William Galvin and his team in Boston have done an excellent job in detailing the specifics of how GPB Capital operates. All of the moving parts, including the parts hidden from investors, are revealed. An excerpt from the complaint in Massachusetts:

By its nature, GPB Capital is structurally complex. Its funds have a number of sub-funds, and those sub-funds have various ownership interests in portfolio companies. Some of GPB Capital’s funds jointly own portfolio companies, like the Prime Automotive Group. Moreover, the property on which many dealerships sit is owned by separate companies under the GPB Capital umbrella. GPB Capital has many hundreds of bank accounts under its purview. GPB Capital-related individuals like Gentile, Lash, Car Executive 1, and Schneider all have various ownership interests related to GPB Capital. Unbeknownst to investors, companies in which individuals like Gentile had ownership stakes engaged in transactions with GPB Capital-related entities. Only some of these relationships were disclosed, and typically after the fact. For example, while GPB Capital disclosed that Gentile is related to an entity called GPB Lender, LLC (which, despite carrying the “GPB” name, is not affiliated with GPB Capital), GPB Capital did not disclose that Gentile’s company would be making loans and collecting interest from GPB Capital funds.

In the Conflicts of Interest section of the Massachusetts complaint, David Gentile’s Scientologist wife Joanne Gentile is named. She is a lawyer. Also named in this section is the Church of Scientology’s Hubbard College:

b. Conflicts of Interest with Related-Party Consultants

254. GPB Capital frequently engages law firms to perform work. One firm engaged was a New York law firm affiliated with Gentile’s wife (“New York Small Firm”). New York Small Firm’s beneficial owners were GPB Capital CFO 2 and Gentile’s wife. GPB Capital CFO 2 and Gentile’s wife are siblings. Gentile’s wife was a partner of the law firm. GPB Capital CFO 2 did not serve as GPB Capital's CFO until after New York Small Firm dissolved.255. New York Small Firm performed services for GPB Capital and received compensation for such services.

256. GPB Capital paid New York Small Firm a monthly fee of over $12,129 in 2016 and 2017.

257. GPB Capital also paid New York Small Firm through LSG Auto bank accounts. On March 29, 2016, an LSG Auto account wired $12,000 to New York Small Firm.

258. As of March 24, 2017, GPB Capital has paid New York Small Firm at least $145,548 in "consulting" fees. At the time, Gentile’s wife was the 100 percent owner of New York Small Firm.

259. In addition, Gentile’s wife was paid $91,291 individually as a “payroll expense.”

260. GPB Capital attempted to classify payments to Gentile’s wife’s law firm as employee compensation.

Advertisement261. In a May 3, 2017, e-mail to Gentile, a GPB Capital executive wrote "along with classifying guaranteed distributions as compensation you should also classify [New York Small Firm] and Hubbard College as compensation. [Gentile’s wife’s] services to the

company come through payroll as an employee.

An older directory shows GPB Capital to be a WISE company. This explains why the firm would have paid the Hubbard College to set up a course room and teach the business “tech” of L. Ron Hubbard. While this would have seemed strange to non-Scientologists, there were, and remain, several Scientologists working at GPB Capital Holdings.

The Massachusetts complaint details the GPB Capital’s exorbitant selling fees:

B. GPB Capital Selling Arrangements

28. The vast majority of investors purchased shares of GPB Funds through independent broker-dealers or investment advisers. Investors who purchased shares wired money through Phoenix American Financial Services ("Phoenix American"), which is the transfer agent for all the GPB Funds.

29. Phoenix American then transmits investment monies to the respective fund, less commissions associated with the investment. Commissions are typically 7 percent.

30. Other selling fees typically included a 1 % due diligence fee, a 1.75% placement fee, and a 1.25 percent wholesaling fee. Organizational expenses could add an additional 1.25 percent fee.

31. The vast majority of shares sold for the GPB Funds are Class A shares. Selling fees for Class A shares are greater than those associated with Class B shares.

32. The GPB Funds receive 87.5 percent to 89 percent of each dollar invested.

Because of the high commissions GPB Capital paid its Broker-Dealers, these B-D’s pushed GPB Capital’s various funds to their retail customers. The money poured into GPB Capital as a result. However, this created its own set of problems as GPB Capital Holdings could not spend the money fast enough on new acquisitions. Instead, as the Massachusetts complaint notes, GPB Capital effectively became a Ponzi scheme by taking in too much money too fast:

As time went on and GPB Capital raised more money, it was unable to deploy its capital efficiently. Instead of limiting contributions until capital was deployed, GPB Capital continued to take on new investors, especially for GPB Automotive and GPB Holdings II. As investor contributions increased, so did the capital required to continue to pay investor distributions. While GPB Capital maintained authority to suspend distributions whenever it wished, the firm continued to make its monthly distributions in order to maintain appearances and stay attractive to investors. In order to keep up with distributions, GPB Capital began dipping into other sources of income, contrary to statements made in its private placement memoranda and marketing materials. GPB Holdings, GPB Holdings II, GPB Automotive, and GPB Waste Management eventually turned to investor contributions to meet the demands of the 8 percent monthly distributions, and the fund financials tell as much.

The question arises here: Why didn’t the Chief Compliance Officer of GPB Capital suspend money coming in from new investors given that the firm could not make new acquisitions fast enough? The answer is that the “Chief Compliance Officer” at GPB Capital is an office with a revolving door. Gentile and Schneider run the firm as their own piggy bank and there has, apparently, never been a Chief Compliance Officer with any real authority.

Instead of throttling back the money coming in, Gentile and Schneider simply used the new money to pay the older investors distributions. Given the Gentile-Schneider pattern of self-dealing and withholding material facts, the allegation that the two crossed the line into Ponzi scheme territory seems consistent with their general dishonesty. In any case, GPB Capital was forced to stop taking in new investor money in 2017 when it ran afoul of SEC regulations and failed to submit restated 2015 and 2016 statements.

One of the bombshell revelations in the GPB Capital Holdings story is the indictment of one of its Chief Compliance Officers named Michael Cohn on felony obstruction of charges. Cohn, 60, worked in the enforcement section of the US Securities and Exchange Commission (SEC) until late 2018.

The US Department of Justice criminal indictment against Cohn alleges that during the course his employment at the SEC, he applied for a position at GPB Capital Holdings. Cohn is accused of illegally accessing SEC computers to which he was not entitled to access. He used his access to obtain confidential information on GPB Capital derived from Federal law enforcement investigations. Cohn then purportedly furnished this information to GPB Capital executives.

Cohn was then offered, and accepted, a $400,000 a year position at GPB as Chief Compliance Officer. Cohn came aboard in late 2018 and was charged in early 2019. Cohn was one of the last people to the party and the first one in handcuffs. Cohn was released on a $250,000 bond and has denied the allegations.

One question that has been asked by so many: Why is it taking so long for the authorities to act against GPB Capital Holdings? The same question was long asked about Danny Masterson. The wheels of justice turn slowly, but when they finally turn, they are devastating.

— Jeffrey Augustine

Here’s The Commonwealth of Massachusetts complaint against GPB Capital Holdings:

GPB Capital: Massachusetts Complaint by Tony Ortega on Scribd

——————–

“It’s a long story. But in 1950, a fellow name of Palmer walked into the Explorers Club just as I was leaving the mail room, and Palmer says to me, ‘Hey, Ron, you want an expedition?’ And I said, ‘Well, sure.’ ‘Well, he says, ‘there’s a whole bunch of Greek and Roman statuary that was being brought from Athens to Rome, and the ship went aground on the north side of the Dodecanese.’ And he says, ‘Been there ever since. And they’ve just located it at about thirty fathoms of water’….And I’ve just been sort of working on this in my spare time and getting it together. Nothing very dramatic in the way of progress….And just today, why, their delay was explained. They had already put it before the Flag Committee and the board of directors and that sort of thing. So the expedition, as of that action, became an official scientific expedition: ocean archaeological survey with the purpose of discovering various periods of marine history in the past, as possibly represented on the floors of sunken harbors long since passed from the view of man where there are, of course, still ships. And I don’t guarantee that we won’t stop by on some of the stuff sunk during World War II and pick up a few tommy guns.” — L. Ron Hubbard, June 22, 1961

“I don’t think that Ron was or is perfect. I doubt that even the Tech itself is perfect, otherwise there would be no room for improvement. But the things that LRH discovered and created are so breathtakingly amazing that it is unfair to criticize him, his writing style, or his work without keeping the reality of his accomplishments in perspective. To do so would amount to a false report because it would be an incomplete report. As I once mentioned on one of the other blogs, it is fairly well documented Sir Isaac Newton behaved ‘strangely’ at times and once had what we would call a psychotic break……so now what? Are we supposed to abolish the laws of physics and declare calculus to be bullshit? In my reality Ron’s discoveries are at least as stellar as Newton’s and he deserves comparable respect and consideration.”

——————–

“The putrefaction shakedown is a more accurate name for it.”

——————–

Full Court Press: What we’re watching at the Underground Bunker

Criminal prosecutions:

— Danny Masterson charged for raping three women: Arraignment scheduled for September 18.

— Jay Spina, Medicare fraud: Sentencing is set for July 6 in White Plains, NY

— Hanan and Rizza Islam and other family members, Medi-Cal fraud: Trial set for October 7 in Los Angeles

Civil litigation:

— Luis and Rocio Garcia v. Scientology: Oral arguments set for July 30 at the Eleventh Circuit

— Valerie Haney v. Scientology: Forced to ‘religious arbitration.’ Hearing on motion for reconsideration set for August 11

— Chrissie Bixler et al. v. Scientology and Danny Masterson: July 8 (plaintiff attorneys pro hac vice), August 31-Sept 1 (CSI/RTC demurrer against Riales, Masterson demurrer), Oct 7-19 (motions to compel arbitration)

— Jane Doe v. Scientology (in Miami): Jane Doe dismissed the lawsuit on May 15 after the Clearwater Police dropped their criminal investigation of her allegations.

— Matt and Kathy Feschbach bankruptcy appeal: Oral arguments were heard on March 11 in Jacksonville

— Brian Statler Sr v. City of Inglewood: Amended complaint filed.

——————–

Scientology’s celebrities, ‘Ideal Orgs,’ and more!

We’ve been building landing pages about David Miscavige’s favorite playthings, including celebrities and ‘Ideal Orgs,’ and we’re hoping you’ll join in and help us gather as much information as we can about them. Head on over and help us with links and photos and comments.

Scientology’s celebrities, from A to Z! Find your favorite Hubbardite celeb at this index page — or suggest someone to add to the list!

Scientology’s ‘Ideal Orgs,’ from one end of the planet to the other! Help us build up pages about each these worldwide locations!

Scientology’s sneaky front groups, spreading the good news about L. Ron Hubbard while pretending to benefit society!

Scientology Lit: Books reviewed or excerpted in our weekly series. How many have you read?

——————–

THE WHOLE TRACK

[ONE year ago] How Scientology is likely going to come back at the explosive new lawsuits

[TWO years ago] Why we think nutty Las Vegas councilwoman Michele Fiore might be a Scientologist

[THREE years ago] HOWDYCON 2017 IS HERE — DENVER IS CLEAR!

[FOUR years ago] CLEARWATER DONE DEAL — Couple seeks big crowd for Scientology ‘disconnection’ billboard

[FIVE years ago] LIVE-BLOGGING: The Toronto conference on Scientology kicks off and we’re on the scene

[SIX years ago] Sunday Funnies: The desperation in Scientology fliers is getting worse. Much worse.

[SEVEN years ago] Meet the Man Behind WWP, the Web Home of Anonymous and Project Chanology

[EIGHT years ago] How Hooters — Yes, Hooters — Could Mess Up Scientology’s Refund Scam

[ELEVEN years ago] Tom Cruise Lured Back Into Scientology By Man The Church Now Says Was “Demoted” And A “Lunatic”

——————–

Bernie Headley (1952-2019) did not see his daughter Stephanie in his final 5,667 days.

Valerie Haney has not seen her mother Lynne in 1,976 days.

Katrina Reyes has not seen her mother Yelena in 2,480 days

Sylvia Wagner DeWall has not seen her brother Randy in 2,000 days.

Brian Sheen has not seen his grandson Leo in 1,020 days.

Geoff Levin has not seen his son Collin and daughter Savannah in 911 days.

Christie Collbran has not seen her mother Liz King in 4,218 days.

Clarissa Adams has not seen her parents Walter and Irmin Huber in 2,086 days.

Carol Nyburg has not seen her daughter Nancy in 2,860 days.

Jamie Sorrentini Lugli has not seen her father Irving in 3,634 days.

Quailynn McDaniel has not seen her brother Sean in 2,980 days.

Dylan Gill has not seen his father Russell in 11,546 days.

Melissa Paris has not seen her father Jean-Francois in 7,465 days.

Valeska Paris has not seen her brother Raphael in 3,633 days.

Mirriam Francis has not seen her brother Ben in 3,214 days.

Claudio and Renata Lugli have not seen their son Flavio in 3,475 days.

Sara Goldberg has not seen her daughter Ashley in 2,513 days.

Lori Hodgson has not seen her son Jeremy and daughter Jessica in 2,226 days.

Marie Bilheimer has not seen her mother June in 1,751 days.

Charley Updegrove has not seen his son Toby in 1,281 days.

Joe Reaiche has not seen his daughter Alanna Masterson in 5,841 days

Derek Bloch has not seen his father Darren in 2,981 days.

Cindy Plahuta has not seen her daughter Kara in 3,301 days.

Roger Weller has not seen his daughter Alyssa in 8,156 days.

Claire Headley has not seen her mother Gen in 3,276 days.

Ramana Dienes-Browning has not seen her mother Jancis in 1,631 days.

Mike Rinder has not seen his son Benjamin and daughter Taryn in 5,934 days.

Brian Sheen has not seen his daughter Spring in 2,040 days.

Skip Young has not seen his daughters Megan and Alexis in 2,442 days.

Mary Kahn has not seen her son Sammy in 2,314 days.

Lois Reisdorf has not seen her son Craig in 1,897 days.

Phil and Willie Jones have not seen their son Mike and daughter Emily in 2,392 days.

Mary Jane Barry has not seen her daughter Samantha in 2,646 days.

Kate Bornstein has not seen her daughter Jessica in 13,755 days.

——————–

Posted by Tony Ortega on June 22, 2020 at 07:00

Posted by Tony Ortega on June 22, 2020 at 07:00

E-mail tips to tonyo94 AT gmail DOT com or follow us on Twitter. We also post updates at our Facebook author page. After every new story we send out an alert to our e-mail list and our FB page.

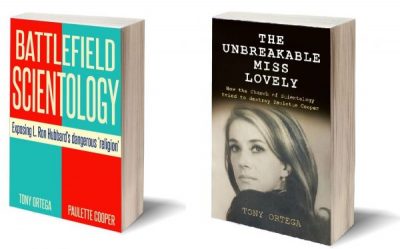

Our new book with Paulette Cooper, Battlefield Scientology: Exposing L. Ron Hubbard’s dangerous ‘religion’ is now on sale at Amazon in paperback and Kindle formats. Our book about Paulette, The Unbreakable Miss Lovely: How the Church of Scientology tried to destroy Paulette Cooper, is on sale at Amazon in paperback, Kindle, and audiobook versions. We’ve posted photographs of Paulette and scenes from her life at a separate location. Reader Sookie put together a complete index. More information can also be found at the book’s dedicated page.

The Best of the Underground Bunker, 1995-2019 Just starting out here? We’ve picked out the most important stories we’ve covered here at the Underground Bunker (2012-2019), The Village Voice (2008-2012), New Times Los Angeles (1999-2002) and the Phoenix New Times (1995-1999)

Other links: BLOGGING DIANETICS: Reading Scientology’s founding text cover to cover | UP THE BRIDGE: Claire Headley and Bruce Hines train us as Scientologists | GETTING OUR ETHICS IN: Jefferson Hawkins explains Scientology’s system of justice | SCIENTOLOGY MYTHBUSTING: Historian Jon Atack discusses key Scientology concepts | Shelly Miscavige, 14 years gone | The Lisa McPherson story told in real time | The Cathriona White stories | The Leah Remini ‘Knowledge Reports’ | Hear audio of a Scientology excommunication | Scientology’s little day care of horrors | Whatever happened to Steve Fishman? | Felony charges for Scientology’s drug rehab scam | Why Scientology digs bomb-proof vaults in the desert | PZ Myers reads L. Ron Hubbard’s “A History of Man” | Scientology’s Master Spies | The mystery of the richest Scientologist and his wayward sons | Scientology’s shocking mistreatment of the mentally ill | The Underground Bunker’s Official Theme Song | The Underground Bunker FAQ

Watch our short videos that explain Scientology’s controversies in three minutes or less…

Check your whale level at our dedicated page for status updates, or join us at the Underground Bunker’s Facebook discussion group for more frivolity.

Our non-Scientology stories: Robert Burnham Jr., the man who inscribed the universe | Notorious alt-right inspiration Kevin MacDonald and his theories about Jewish DNA | The selling of the “Phoenix Lights” | Astronomer Harlow Shapley‘s FBI file | Sex, spies, and local TV news | Battling Babe-Hounds: Ross Jeffries v. R. Don Steele